A political and economic masterstroke would be for the Union budget to contain a basic income scheme for the bottom 50 percent — the poor and lower middle class

What Prime Minister Narendra Modi’s speech of December 31 made clear was that India was firmly moving away from the anti-poverty policies pursued by all previous governments. The new approach, made possible by technology, is to get away from the Amartya Sen-advocated in-kind income transfers to some version of cash transfers.

Two major in-kind poverty alleviation policies in operation are the PDS and MGNREGA. Both involve largescale government involvement. The former has the government (Food Corporation of India) involved in procurement, storage, transport and distribution of food. MGNREGA has the government planning projects, employing people, on what is touted as the largest work programme in the world. What is not as well advertised is that both are amongst the most corrupt schemes in the world. Though given the recent demonetisation effort, one must add the biggest daddy of all corrupt — the Indian tax administration — to the list.

Study after PDS study has proven Rajiv Gandhi right in his (informed) 1985 conjecture that no more than 15 per cent of PDS food distribution reaches the poor. What is not well recognised, especially by persistent PDS advocates, is that only 50 per cent of food procured and stored by the government reaches anybody, rich or poor. Where does this 50 per cent go? Towards the generation of black income for corrupt officials, liquor manufacturers, food mills, etc. Ditto with the MGNREGA programme where jobs (and income) are allocated to ghost workers and panchayat leaders. Together, the black income generated by these two programmes is over one per cent of GDP, or Rs 175,000 crore.

Helped by technology and Aadhar (Supreme Court, please note), the Direct Benefit Transfer (DBT) scheme has gathered considerable momentum over the last few years. A logical expansion of the DBT is the policy of Universal Basic Income (UBI), a guaranteed minimum income to all (population, adult, worker or variant thereof). Chief Economic Adviser Arvind Subramaniam has stated that the new Economic Survey will contain a large section on UBI. For those interested in efficient redistribution of income, this news is extremely welcome.

But should income transfers be universal, to every individual in the economy, or targeted to specific individuals? And should the government continue to pursue schemes like PDS and MGNREGA, or should such wasteful and corrupt government schemes be scrapped, so that deserving individuals can get more? These questions will hopefully be addressed in the Economic Survey.

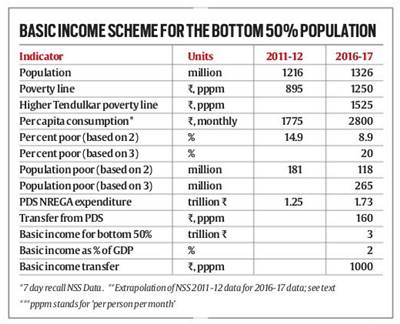

Meanwhile, some preliminary calculations to aid our thinking, and formulation, of a UBI policy. The table contains some basic data for the Indian economy for 2016-17. If the assumption is made that the distribution of consumption has not changed since 2011-12 (the real distribution did not change between 1983 and 2011-12, so this is an eminently reasonable assumption), reasonable calculations can be made about the magnitude and efficacy of income transfer policy.

For 2011-12, data are from the NSS survey. For 2016-17, approximate (and lower bound) consumption data are from wage data for ploughman and carpenters. The rate of growth in the wages of the poor and semi-skilled indicate an increase of 58 per cent and 69 per cent respectively over the last five years. The lower 58 per cent growth is taken as the mean growth in expenditure for all. Consumer prices rose by 40 per cent between 2011-12 and 2016-17; this implies that the Tendulkar poverty level in 2016-17 is no more than nine per cent of the population.

This background information for India, 2016-17, yields important policy conclusions. The defining line for the absolute poor should not be absolute — it should increase with the level of per capita income and should include the lower middle class . The Tendulkar definition of poverty is now obsolete; it captures too few of those deserving income transfers.

A poverty line some 22 per cent higher (Rs 1,525 per person per month) than the equivalent Tendulkar poverty line of Rs 1,250 for 2016-17 yields a national poverty rate of 20 per cent. The average poverty gap with the higher poverty line is about Rs 300 per poor person per month. The poverty gap is defined as the difference between the average consumption level of the poor and the relevant poverty line. To reduce this new absolute poverty level (20 per cent of population) to zero, the government needs to transfer, on an annual basis, Rs 1 lakh crore (lc), only 0.7 per cent of GDP. At present, via PDS and MGNREGA, the government spends Rs 1.75 lc (PDS 1.35 lc and MGNREGA 0.4 lc).

So, here is an efficient way for the government to eliminate poverty on an ongoing basis, and to help the lower middle class as well. The demonetisation policy will allow increased personal income tax collections, possibly around Rs 1 lc to Rs 1.5 lc annually. Thus, Rs 3 lakh crore is available with the government for redistribution if it decides to scrap PDS and MGNREGA. Besides, if the government is serious about rooting out corruption, no better place to begin. Income tax and data on consumption of automobiles and two wheelers can easily help the government target the bottom 50 per cent.

Without any strain on the budget, the government can transfer Rs 3 lakh crore to 265 million people, or approximately Rs 1,000 per person per month. This will result in a 50 per cent increase in consumption for the (median) 50th percentile consumer; and a 65 per cent increase for the 25th percentile consumer. The PDS scheme, at best, transfers Rs 160 per month to each person, rich or poor, lucky enough to receive the transfer (a subsidy of Rs 20 for each kg of PDS food consumed).

The Opposition is demanding that the Union budget be postponed because there are elections in five states in February and March. Even though there is a 2012 precedent, this demand seems most illogical. However, it is not an absurd political demand.

Perhaps the Opposition has broadly done the above calculations and believes it is likely that a targeted basic income transfer scheme is in the offing. If such a policy is announced, it will be an economic and political masterstroke. Which is why the Opposition will go to extreme lengths to prevail. Unfortunately for them, they don’t have logic, law or the numbers in Parliament to prevail.

-Indian Express

No comments:

Post a Comment